A Guide to Mortgage Buydowns

For some prospective homebuyers, rising interest rates might make it feel like the dream of homeownership is slipping away. The good news is that even in a high-rate environment, you have multiple strategies to help you lower your interest rate or the total cost of your loan. One such strategy is the mortgage buydown.

Mortgage buydowns — available with some loan programs — are not new. But they tend to gain more attention when interest rates rise because they can help buyers save money on their loans.

What is a mortgage buydown?

Sometimes referred to as a rate temporary buydown, a mortgage buydown is where the seller (or, in some cases, the builder or the lender) agrees to subsidize the monthly interest you pay during the first one to three years of your mortgage. This translates to a temporary discount on your interest rate — usually one to three percentage points. A mortgage rate buydown can thus save you thousands of dollars during those first years of home ownership.

Temporary rate buydowns typically appeal to buyers who are optimistic about the medium-term (three- to five-year) interest-rate trend . “A mortgage buydown is really for those who have an opinion on the market that rates will drop at some point in the next 48 months or so,” says Cameron Findlay, chief economist, AmeriSave. “At that point, the buyer is no longer benefitting financially from the buydown. But in that new, lower-rate environment, they can refinance and have that lower monthly payment.”

Watch Cameron Findlay, chief economist, AmeriSave, discuss mortgage buydowns.

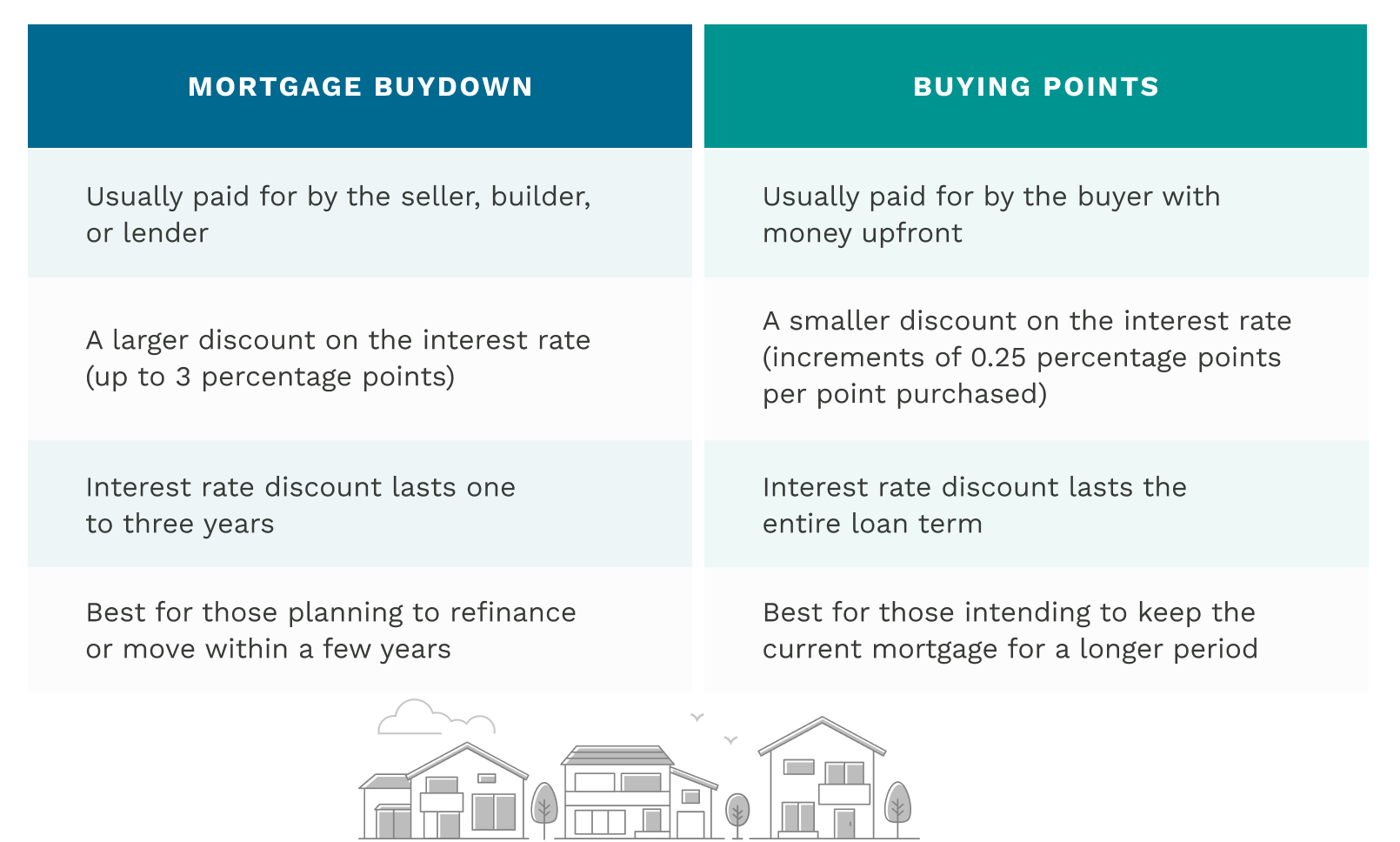

A mortgage buydown is similar in some ways to buying points. With mortgage points, you pay additional closing costs, and the mortgage lender drops the interest rate. One point usually costs $1,000 per $100,000 of the home’s sale price and drops the interest rate by .25% for the life of the loan. With a buydown, the seller usually pays, and the interest rate drops more significantly, but the initial rate period ends after one to three years.

Your mortgage lender will let you know if a mortgage buydown is available with your loan before you apply.

Types of mortgage rate buydowns explained

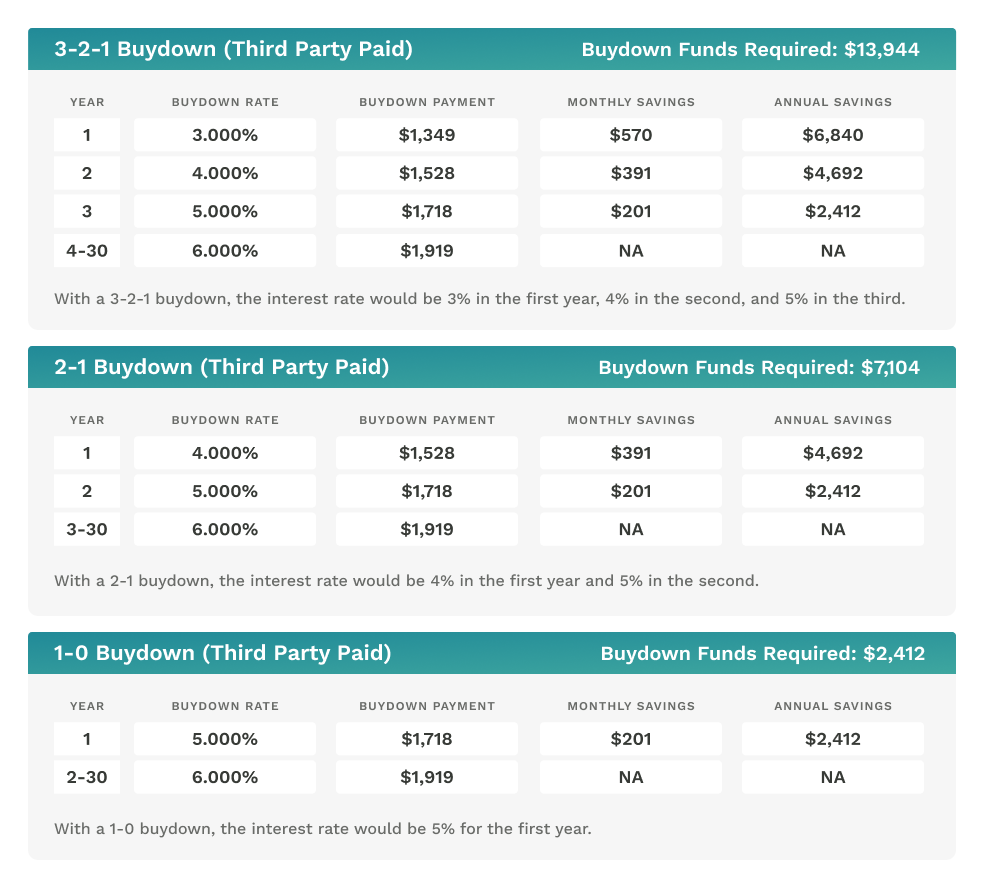

Types of mortgage rate buydowns are explained with a series of numbers that indicate their structure and term.

- Typically referred to as 1-0, where the interest rate is lowered by 1 percentage point for the first year of the loan.

- Alternatively, there’s 2-1, lowering the interest rate by 2 percentage points for the first year and 1 percentage point for the second year.

- Similarly, 3-2-1 involves lowering the interest rate by 3 percentage points for the first year, 2 percentage points for the second year, and 1 percentage point for the third.

After the buydown term ends, regardless of the structure, the interest rate returns to its original level.

Mortgage rate buydown examples

Let’s say you want to buy a $400,000 house. You can make a 20% down payment, so you’ll need to finance $320,000. Your lender has offered a 6% interest rate but has also offered some mortgage buydown options for an initial lower payment.

You need to communicate to the seller your desire to do a mortgage buydown, positioning it as a concession on the sale (more about this in a bit). If the seller agrees, they establish an escrow account at closing and fund it with an amount of money roughly equivalent to the total savings. The lender then withdraws money monthly to account for your interest rate discount.

How a mortgage buydown benefits the seller, builder, or lender

A mortgage buydown is a concession by the seller, builder, or mortgage lender. So why would they go along with this? It comes down to market conditions — supply and demand.

In a strong sellers’ market with low mortgage rates and high demand — such as we saw during most of 2022 — sellers often can insist on their asking price and even entertain bidding wars among prospective buyers. In a weaker seller’s market with higher rates, demand dries up (many buyers feel they’re priced out of the market), and sellers feel more pressure to prompt a sale.

“A mortgage buydown is good for the seller in the sense that it will encourage more qualification and that people will be able to relieve some of that initial burden that monthly payments up front in the first couple of years,” says Findlay. “I think for the lenders, they’re providing this as a way for consumers who believe interest rates will drop in the future. They would be willing to take on a slightly higher short-term interest rate for the benefit of refinancing that mortgage later on down the road.”

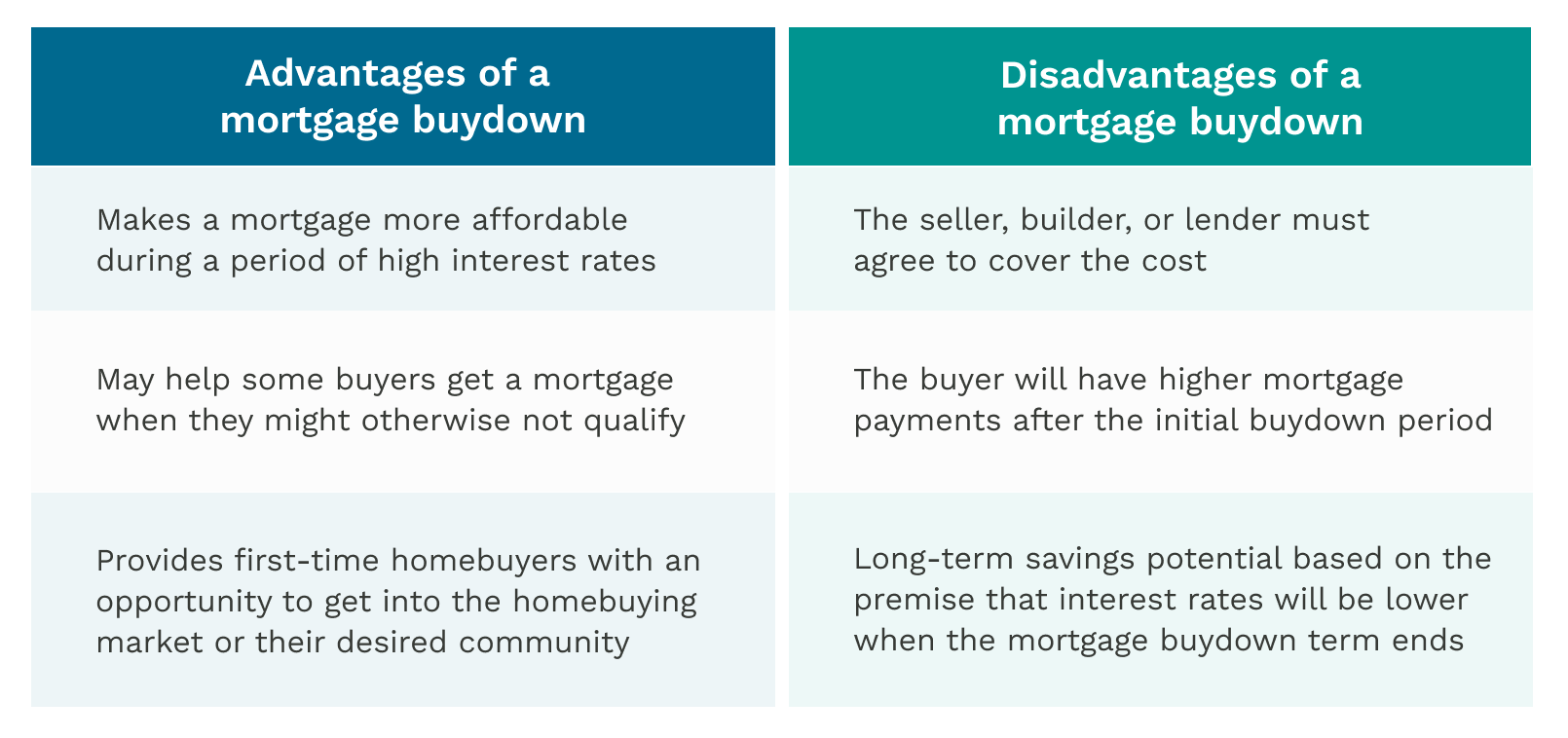

Pros and cons of a mortgage buydown

A mortgage buydown may make a lot of sense for a buyer and a willing seller. But you owe it to yourself to understand the pros and cons of this approach.

How to negotiate a mortgage buydown

The first step toward saving money with a mortgage buydown is to talk to your lender to see if it’s even an option. Mortgage buydown rules vary by loan program, so you’ll want to be sure your program allows them.

Next, discuss your mortgage buydown options with your realtor. They can advise you on the approach and include the proposed buydown in the offer letter as a seller concession. Your realtor can also discuss with the seller’s agent exactly how the buydown will make the home purchase more feasible for you.

“You have to have a dialogue with the seller as to whether or not they’re interested in a mortgage buydown,” Findlay says. “That would come through in the form of a credit in the closing statement, which would be incorporated into the loan.”

He adds, “The lender can walk the consumers through the mortgage buydown process. It may sound complex, but it’s really not. These kinds of tools have been employed to relieve consumer debt loads, especially when we’ve seen rates increase so rapidly.”

Alternatives to mortgage rate buydowns

If a temporary buydown isn’t an option, or you just want to explore other ways to save money on a home purchase in a high-interest-rate environment, consider these alternatives.

Buying discount points

As explained earlier in this article, points require you to pay more at closing in return for a lower mortgage rate that lasts the life of the mortgage.

Consider an adjustable-rate mortgage (ARM)

An adjustable-rate mortgage offers an introductory interest rate that may be multiple percentage points lower than that offered by a 30-year fixed-rate mortgage. That introductory period typically lasts three, five, or seven years, after which the rate changes annually based on market rates.

Negotiate a lower price

In a higher-interest-rate environment, with lower demand, sellers may be more open to negotiating their asking price. Discuss this optio n with your realtor so you can make a competitive offer.

A mortgage buydown can keep the dream of home ownership alive … and well!

Rising interest rates can add hundreds of dollars to a new homeowner’s monthly mortgage payment. With a temporary mortgage buydown, you can claw some of those hundreds back for the loan’s first one to three years. A buydown buys you some time for rates to decrease so you can refinance to a more affordable monthly payment.

Frequently asked questions: Mortgage buydowns

What is a mortgage rate buydown?

A mortgage buydown is a way for you, as a homebuyer, to get a lower interest rate on your loan. The seller (or, in some cases, the builder or the lender) agrees to subsidize the interest during the first one to three years of your mortgage. This translates to a temporary discount — perhaps one to three points — on your interest rate.

Are mortgage buydowns worth it?

A mortgage buydown is worth pursuing in times of high interest rates, and usually only if you can refinance the loan to a lower rate after the buydown term ends.

AmeriSave Mortgage

AmeriSave Mortgage

AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage