What are Mortgage Points and How Can They Help?

Mortgage points are a good idea for many home buyers, though not everyone can benefit from them and for some, they may not make good financial sense. With a bit of understanding and some quick math, you can determine if buying points is a good strategy for you.

Buying mortgage points can help you earn a lower interest rate on your mortgage. Having a lower rate, in turn, helps you save money over the life of the loan. Simply put, by paying points upfront as part of your overall closing costs, you can potentially save a lot of money over the life of the loan.

Let’s take a closer look at this potentially money-saving option for your mortgage.

Are mortgage points something to consider?

You’ve prepared yourself financially to buy a new home — one that you’re planning to stay in for many years. You’ve paid down your credit cards and other high interest debt, helping you earn a lower interest rate from the mortgage provider. You’ve saved enough for a 20% down payment to avoid paying for private mortgage insurance (PMI) . You have plenty of money left in reserve.

Feeling empowered, you’re now wondering if there are other ways you can save money over the life of your home mortgage. You may be in a perfect position to buy mortgage points.

How do mortgage points work?

Mortgage points (which are sometimes called discount points) are one of the many things you need to consider when you finance your home purchase.

If current mortgage rates are high, can buy mortgage points from the lender to trim the interest rate on the loan. Each point costs 1% of the loan amount and lowers the interest rate typically by 0.25% (though this percentage may vary by lender). You decide whether you want to buy points while negotiating your mortgage. You then pay for them as part of your closing costs.

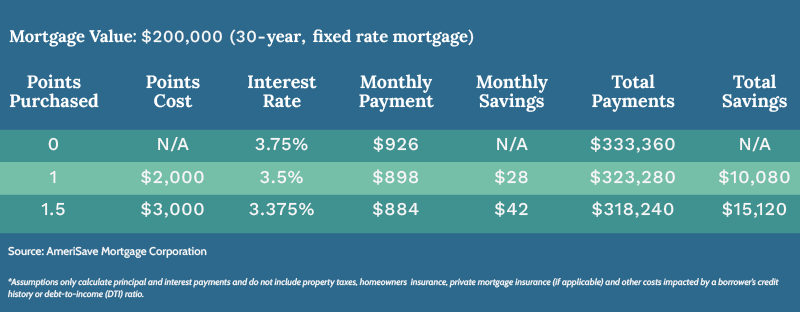

Let’s say you’re applying for a $200,000 mortgage with a 3.75% interest rate. One point would cost you $2,000 at closing and drop the interest rate to 3.50%.

You can also purchase multiple points or fractions of a point. So, in the example above, buying 1.5 points would add $3,000 to your closing costs and drop the interest rate to 3.375%.

Here’s how much you’d save over the life of the loan by purchasing discount points upfront:

Points are generally tax deductible, which means buying mortgage points can help you save at tax time. If you itemize deductions on your returns (as many homeowners do), you can write off the amount of money you spend on mortgage points along with any mortgage interest you pay. Read our comprehensive list of common tax deductions for homeowners to maximize your savings. A certified tax professional can advise you on itemizing your return.

How do I know if buying points is worth it?

Spending a few thousand dollars extra up front to save tens of thousands in the long run may seem like a solid strategy. And for many homebuyers, purchasing discount points does indeed make good financial sense.

But before you decide to pay points, make sure the following statements apply to you:

Buying mortgage points won’t affect my down payment

If spending money to buy points means you’ll have less to spend on your down payment, then you might want to reconsider. A lower down payment will likely mean you’ll have a higher interest rate due to having a higher loan-to-value (LTV) ratio. You may also pay more for PMI, increasing your monthly mortgage payment. Remember that if you make a down payment of at least 20%, you avoid paying for PMI altogether.

So be aware that it may make more sense to put the money you could use on discount points towards the down payment instead. Your mortgage lender should be able to walk you through some scenarios that compare a larger down payment to buying points.

I’ll own the home long enough to recoup the cost of the mortgage points

If you’re only planning to live in the home for a short period, you again might want to reconsider buying points. That’s because it’s going to take some time — possibly several years — for your savings to recoup the cost of the points. In other words, you’re not truly saving money on your mortgage until the total amount of those savings exceeds what you spend on the points. That’s known as your “break-even point.”

Calculate the break-even point by dividing the cost of the points by your expected monthly savings. This will tell you how many months it will take to break-even and start to benefit from the upfront costs of mortgage points.

I’m unlikely to refinance or pay off the mortgage before the break-even point

A related consideration is whether you’ll pay off the loan early by making extra mortgage payments or decide eventually to refinance to get a lower mortgage interest rate.

Remember that points save you money over the long haul. The longer you have the mortgage, the more you save. Refinancing or paying off the mortgage before you reach the break-even point negates that money-saving power.

So if paying off your mortgage early is in your plans or you believe interest rates will drop to the point where you’ll want to refinance, then you might want to consider not buying points.

Use our early mortgage payoff calculator to see how much you’ll save.

The pros and cons of buying mortgage points

As you can see, mortgage points offer both advantages and disadvantages, depending on your situation. Make sure you understand these pros and cons when deciding whether paying for mortgage discount points is right for you.

- Pros

- Can help you get a lower interest rate, regardless of your credit score and DTI ratio

- Can help you save a lot of money over the entire term of your mortgage

- Tax-deductible if you itemize your returns

- Cons

- Upfront investment can be substantial — that money may be better put to other uses, such as paying down high-interest debt or higher return investments

- If you buy points at the expense of a large down payment, you may end up having to pay for PMI

- Money-saving benefits will disappear if you sell the home or refinance before the break-even point

The power of points

Mortgage points are one of the tools available to you, as a homebuyer, to fine-tune your mortgage. By allowing you to lower your interest rate, they can help you save money over the life of the loan. But points do come at a cost, and you want to be sure buying them is worth the money you save.

And remember that mortgage points are just one way to save money on your mortgage payments.

Other important questions about mortgage points

Can I buy points with an adjustable-rate mortgage (ARM)?

Yes, you can buy mortgage points with an ARM. Just be sure that the break-even point occurs — and you realize some savings — before the interest rate adjusts. Note that some lenders may provide the points discount only during the initial fixed-rate period.

Are mortgage points the same as mortgage origination points?

Mortgage points and mortgage origination points are different things. Whereas mortgage points are credits you buy to earn a lower interest rate, origination points are fees you pay to the lender at closing to process your mortgage. One origination point usually costs 1% of the total amount of the mortgage. So if your lender charges you one point for a $200,000 loan, you’ll pay $2,000 in origination points.

What are lender credits, and how do they work?

Lender credits do the opposite of what mortgage points do. With lender credits, you pay a higher interest rate in return for paying less for your closing costs. As with mortgage points, you should do the math to understand the long-term financial effect of using lender credits and make sure it matches your goals. Your lender should be able to help you decide whether lender credits are right for you.

Are mortgage points available with every loan?

Mortgage points are not necessarily available with every home loan. It’s ultimately up to the mortgage lender to decide if they want to give you the option of using points .

Now that you understand mortgage points, you can make a more informed decision as to whether they can help you save. Just remember that they provide their greatest benefit over the long haul — over the life of the mortgage. Learn more about buying a home with AmeriSave.

AmeriSave Mortgage Corporation and its affiliates do not provide tax or financial advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax or financial advice. We encourage you to consult with your own tax or financial advisors about the tax or financial implications of your home loan and to identify a plan that works best for your particular situation.