Borrowing Home Equity: What’s Ideal for You?

Rising home values in 2022 and into 2023 have contributed to overall market volatility and made it more challenging to be a buyer. However, this real estate market has proven to be a boon to many homeowners who are content to stay put. That’s because higher home values mean they have more equity than ever. That equity is a potential source of cash they can use for purposes ranging from debt consolidation to home improvements and funding higher education.

Are you thinking about tapping into your home equity to borrow money for these or other purposes? It’s a good idea to understand the limits on what you can borrow and the different ways you can use that equity. Not all options are the same, and some are better suited to specific purposes than others. Keep your financial situation in mind as you read about borrowing equity in your home.

Home equity loans trends in 2023

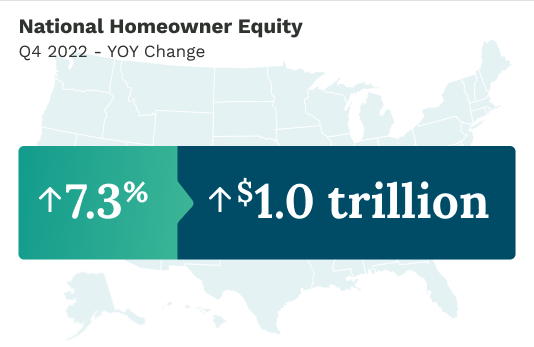

2022 was a big year for home equity. According to CoreLogic, national home equity in the fourth quarter of 2022 grew by 7.3% compared to the fourth quarter of 2021, reaching $1 trillion. Meanwhile, according to Inside Mortgage Finance, equity loan originations increased by 4.2% in the third quarter of 2022 compared to the second quarter of 2022.

Understanding home equity loan: Calculating potential funds for renovations, debt consolidation, or education

Nationally, home values are not expected to increase at the same rate in 2023. But even if values stay stable or decrease a bit, many homeowners will find the coming year an excellent time to tap their home equity.

“We don’t have a crystal ball, but I think home values in many markets will continue to appreciate,” says Thomas Bullins, mortgage sales manager at AmeriSave. “So, is this the right time to tap your home’s equity? Well, my perspective is if the transaction makes sense for a homeowner today, they shouldn’t worry about what the market will or won’t do. I’m optimistic that equity will continue to improve over the long run, giving people more access to it over time.”

Home equity requirements, in brief

Typically, most lenders will allow you to borrow up to 80% of your combined loan-to-value (LTV) ratio, though some mortgage lenders approve loans or lines of credit for more. Your lender will require a good credit score, proof of steady income, and a low debt-to-income ratio. The lender will typically prefer your LTV ratio to be under 80% (more about LTV later in the article), but this may vary based on the product type and lender.

To accurately determine your home’s value (part of the equity calculation), the lender will likely require a home appraisal or another type of home valuation depending on the loan type selected.

How to calculate the equity in your home

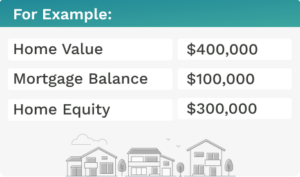

The home equity calculation is fairly simple. Subtract your current mortgage balance (what you owe) from your home’s current value:

Home value – mortgage balance = home equity

Understanding home equity loan: Calculating potential funds for renovations, debt consolidation, or education

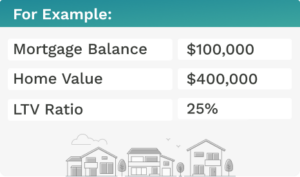

You can calculate your LTV ratio using the same figures.

(mortgage balance / home value) * 100% = LTV ratio

Understanding home equity: Calculating potential funds for renovations, debt consolidation, or education

How to take equity out of your house

You have multiple options for tapping into your home’s equity. There are typically no restrictions on how you use the money accessed through home equity, but some options may be better suited to certain uses.

For instance, if you’re planning to fund home renovations like a kitchen remodel, have received bids, and know you’ll need $50,000 to pay the contractor, then a home equity loan or refinance with a lump sum payment might make the most sense.

On the other hand, if you plan to make a series of updates and renovations to your home over two years and you’re unsure of the exact amount you’ll spend, you might appreciate the flexibility of a HELOC.

When in doubt, a loan expert can help you sort through the options and determine the best way to tap into your home equity.

“Touch base with a professional and trust a professional,” says Bullins. “Call AmeriSave. Call someone in the business you trust, who knows what they’re doing and has experience with mortgages. Follow their advice.”

You should also consult with a certified tax preparer, especially if you plan to use the borrowed money to pay for home improvements. The interest paid may be tax-deductible if you use the funds to improve or renovate the home that secures the loan or HELOC.

Using home equity for debt consolidation

After a slight dip during the pandemic, Americans’ total credit card debt has skyrocketed again. The New York Federal Reserve reported a $38 billion increase in credit card balances in the third quarter of 2022, a 15% year-over-year increase and the largest in two decades!

With credit card interest rates often around 20%, those balances can drain your finances, strain your budget, and hinder your financial and non-financial goals. That’s why many people turn to their home equity for help. While it’s crucial to change the financial habits that led to deep debt, replacing high-interest credit card debt with a home equity loan at a single-digit interest rate can save thousands of dollars.

Bullins states, “Tapping into equity can alleviate pain and fix financial burdens. Generally, it’s a good decision to do so. I think there are very few instances where, if it’s financially beneficial, it doesn’t make sense.”

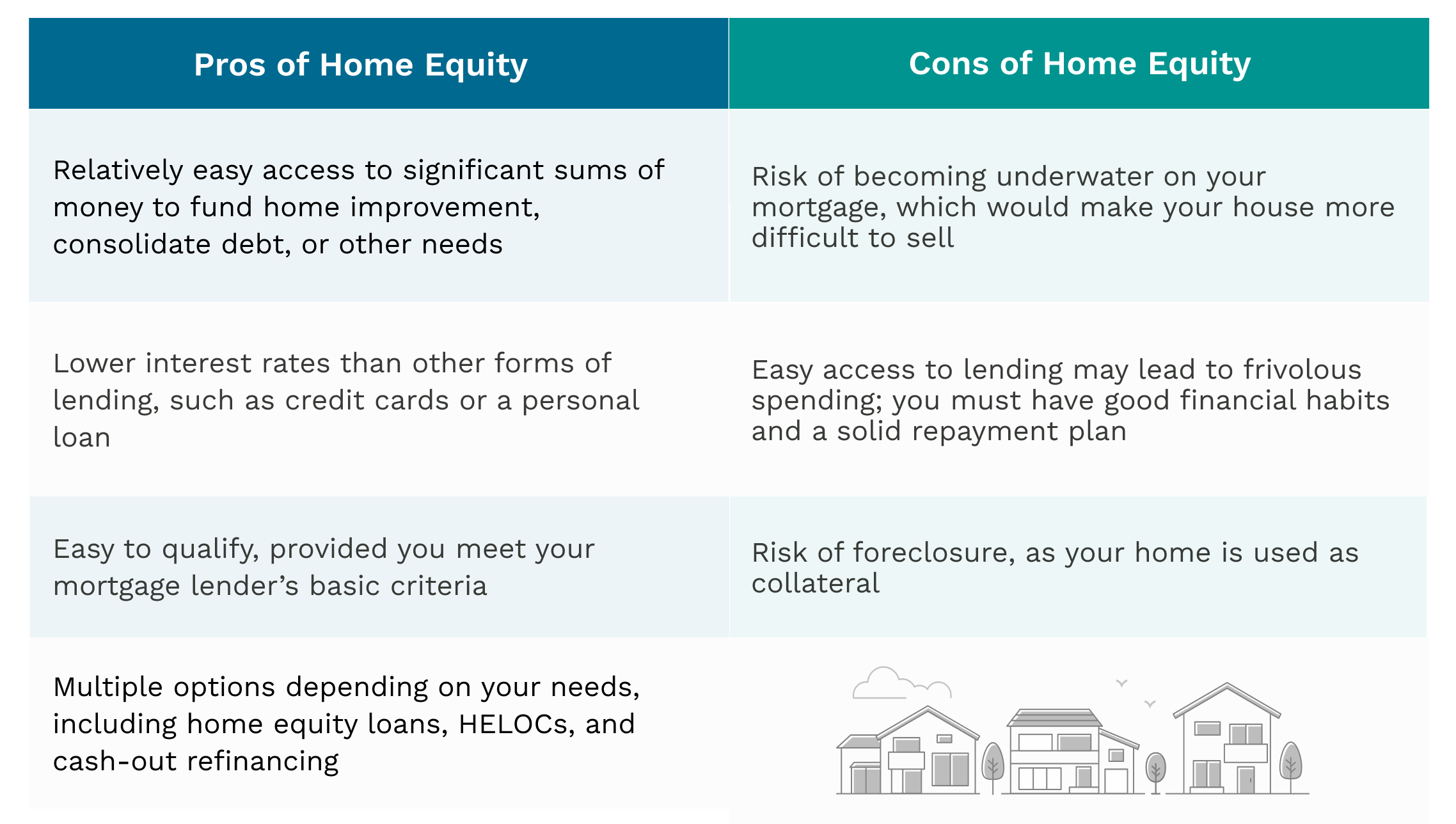

Pros & cons of taking out equity

While tapping your home’s equity can be an excellent way to get money for your goals, it comes with potential drawbacks. You owe it to yourself to understand the pros and cons and approach a home equity loan with your eyes wide open.

Unlocking home equity loan can finance your goals. Discover how to tap into your home’s value responsibly.

Considering the stakes (your home is collateral), it’s crucial to use your home equity responsibly. “Suppose a borrower uses their equity to consolidate all of their debt,” says Bullins. “Now, this person is debt-free except for their mortgage. But then they gradually start using credit cards again, along with other revolving accounts and possibly some personal loans. Before they know it, they’re back in the same position they were in two or three years ago. That’s why it’s essential to have solid financial habits in place before using your home equity.”

Building home equity

You begin building home equity when you purchase a home, take out a mortgage, and make a down payment. For example, if you buy a $400,000 home and make a 20% down payment ($80,000), that $80,000 is your initial amount of home equity.

You can then build equity in three ways.

- Make your monthly mortgage payment. Each payment includes both interest and principal that goes toward paying down your mortgage. Each payment of principal adds to your home equity. Once the mortgage is paid off, you reach 100% equity.

- Benefit from an increase in your home’s value. While 2022 saw sharp rises in home values in many areas, historically, values increase by about 3% per year. If your home’s value increases from $400,000 to $450,000 over 10 years, that $50,000 difference adds to your equity.

- Improve your home. Any effort to enhance your home can add value and increase your equity. This includes adding living space, finishing a basement, or updating a kitchen or bathroom.

Another way to understand home equity

Imagine buying a $400,000 home, represented by an empty five-gallon bucket.

Making a 20% down payment is like pouring the first gallon of water into the bucket — that’s 20% equity!

Making your mortgage payment adds a little bit of water each month. It takes time, but little by little, you build up equity by filling the bucket.

You can also hope to see your home’s value increase over time due to appreciation. A 20% increase in your home’s value, from $400,000 to $480,000, is like adding a gallon of extra volume to the bucket (now you have a six-gallon bucket). Even better, that extra volume is already filled with water. Not only has your home’s value increased, but so has your home equity!

Finally, you can often add to the bucket by improving your home. Finishing your basement, for instance, might add yet another half-gallon of water to the bucket.

Achieve your financial goals with home equity

Like many homeowners, you may have seen a significant increase in your home equity in recent months. This equity represents money you can access for a wide range of needs. Used responsibly, home equity loans, lines of credit, and cash-out refinancing can help you achieve your financial goals.

Frequently asked questions:

What is equity in a home?

Home equity is the value of your home minus the amount you still owe on your current mortgage (the mortgage balance). Expressed as a percentage, equity represents the amount of your home that you truly “own.”

How much equity can I borrow from my home?

Mortgage lenders typically allow borrowers to tap up to 80% of their home equity in the form of a loan, line of credit, or cash-out refinancing. Some lenders allow percentages even higher than 80% for qualifying borrowers.

How soon can you pull equity from your home?

Provided you meet all other lender requirements, including minimum equity levels and LTV ratio, you may be able to tap your home’s equity as soon as you close on the purchase. Contact your mortgage lender to understand their guidelines.

How long does it take to get a home equity loan?

The approval time for a home equity loan may range from a couple of weeks to a couple of months. You may help speed up the process by having all your required documentation ready and responding to lender inquiries promptly.

Is there a minimum for home equity loans?

According to Experian, home equity loans typically have a $10,000 minimum. However, this varies by mortgage lender.

AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage