How to Use Home Equity Responsibly

You’ve built some equity in your home. Now you’re thinking about tapping it to get cash that could help you remodel, invest in a small business, or pay off student loans.

It’s understandable, and you’re not alone. Rising home values have driven equity to historic highs. This, in turn, has helped drive a sharp rise in home equity financing. According to TransUnion, home equity line of credit (HELOC) originations increased 41% in the second quarter of 2022 compared to the second quarter of 2021. Originations of home equity loans increased 29% during the same period.

But just because you can use your home equity doesn’t always mean you should. Tapping your home’s equity means entering into debt with your home as collateral, which means paying back your lender with interest. This fact should be top of mind when considering your home equity options and deciding if it’s really the best way to get the funds you need.

What are the risks of using home equity?

Tapping your home equity through a home equity loan, HELOC, or cash-out refinance has some risks.

• You could lose your home if you fall behind on your repayments.

• If you tap a high percentage of your equity and your home’s value drops, you could fall into a negative equity situation (also known as “being underwater”). This could make it challenging to sell your home.

• A HELOC or cash-out refinance may have a variable interest rate. So if rates rise, your repayment amount will rise as well.

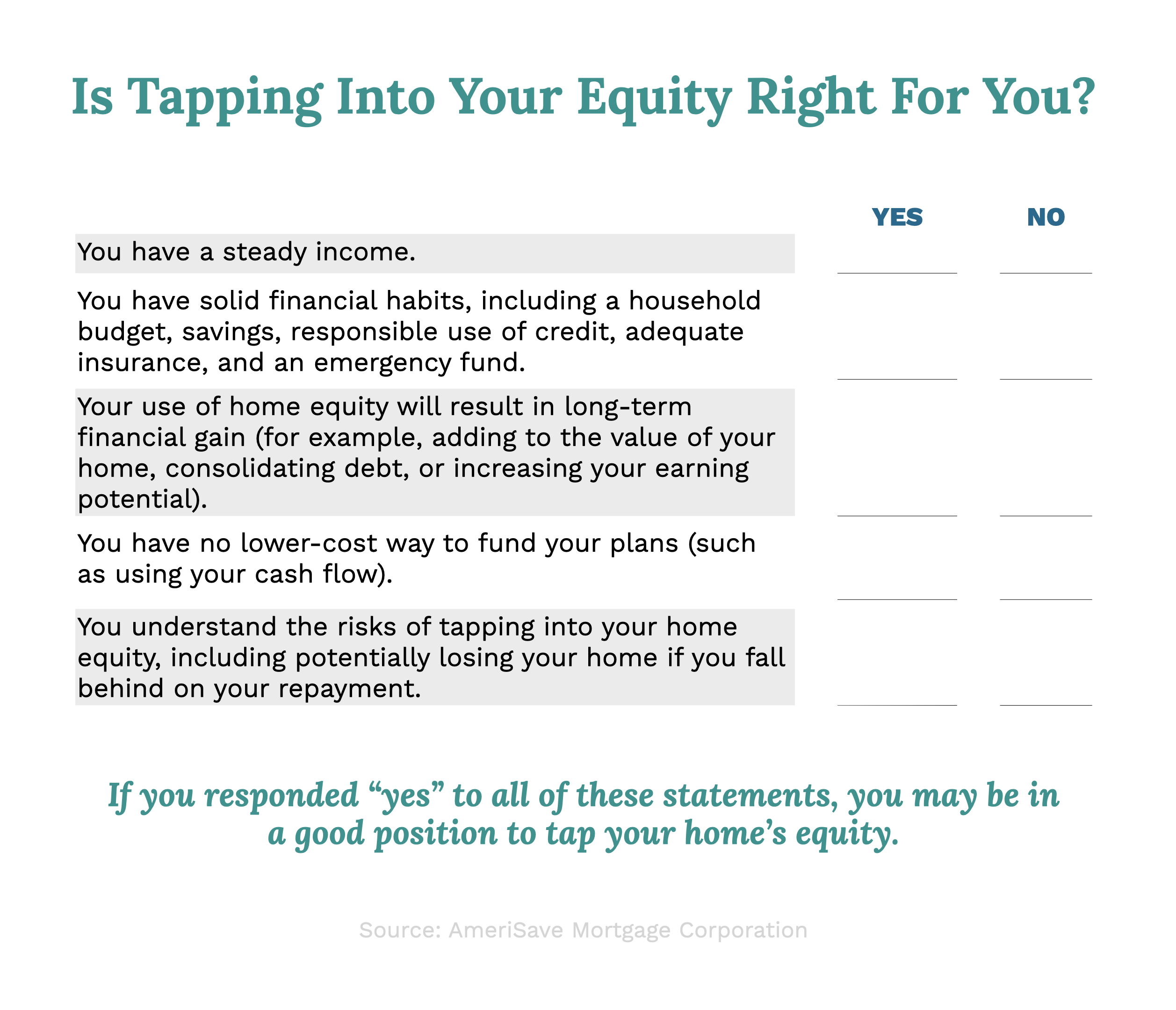

So is it a good idea to tap home equity? It depends on your mindset, your current financial situation, and how you intend to use the funds.

Is it the right time to tap into your home’s equity?

When assuming any debt, you want to have healthy personal finance habits, including the ability (and a plan) to pay back that debt promptly. You want to ensure you have no other reasonable, lower-cost way to fund your plans, including saving a bit more money and just paying with cash. And it’s advisable to limit your home equity to uses that will provide a positive return on investment, such as increasing the value of your home or increasing your earning potential.

If these statements apply, a home equity loan, HELOC, or cash-out refinance might be right for you. Let’s explore some of the common ways you can use your home equity, and some of the factors you want to consider when deciding whether these are a good idea.

Using home equity for home improvements or major repairs

Homeowners have the option to utilize home equity for a variety of home improvement and repair projects. These include finishing a basement, expanding living space for a growing family, or modernizing a kitchen.

Considerations to keep in mind: • Prioritize projects that increase your home’s value or address critical repairs to maintain its market worth. • Maintain an emergency fund for routine maintenance and unexpected service costs. • Some renovations, such as energy-efficient upgrades like solar panels, may qualify for tax credits. Consult with a certified tax professional for detailed guidance.

Consolidate debt or pay off existing student loans

Credit card debt is returning to pre-pandemic levels. According to Equifax, “total card balances in the U.S. hit $916 billion in September, nearly identical to December 2019 levels.”

Fortunately, you can use home equity to consolidate high-interest debt such as credit cards or student loans. By consolidating high-interest debt to a home equity loan, HELOC, or cash-out refinance, you should see significant savings in lower interest rates. Consolidating can also simplify your financial life: rather than paying off multiple credit cards and loans, you’ll have just a single, monthly payment to your mortgage lender.

Here’s a quick example. Say you’ve amassed $20,000 worth of credit card debt, and you can afford to pay if down at $400 per month. At a 20% interest rate, you’ll pay down the debt in about 10 years, including more than $24,000 in interest! At a 7.5% interest rate, you’ll pay down the debt in five years, including only $4,000 in interest.

Factors to consider:

• As part of your debt consolidation efforts, be sure you first curb the spending habits that got you deeply into debt in the first place.

• You should set up a plan that ensures you’ll make timely monthly payments and pay down the home equity debt.

Pay for higher education

With the cost of higher education continuing to grow (with no peak in sight), you can use home equity to help fund college or post-graduate studies for you or your children.

Factors to consider:

• Many student financial aid programs may have lower interest rates than what’s available with home equity financing. These might be a better avenue for funding an education.

• Be honest with yourself about the likelihood of long-term financial gain. In other words, consider limiting your use of home equity money to a disciplined student pursuing a degree with a high earning potential.

To start a business

Business loans for new ventures are often difficult to get and can come with high interest rates. For that reason, you might consider using the equity in your home to finance your new business.

Factors to consider:

• According to the U.S. Bureau of Labor Statistics, approximately 20% of new businesses fail in their first year! So do all you can to research your market and competition, and move forward with home equity financing only if you can be reasonably confident in your success.

• Increase your chance for entrepreneurial success by following a business plan and budget to cover business expenses. Seek out the support of a small business advisor.

To invest in real estate

Home equity can be used for real estate investments, such as to buy rental property or a house you intend to flip.

Factors to consider:

• Maximizing return on investment should be the focus. You need to understand the market, including how to price a rental or flip a home for profitability.

• If you’re flipping a home, you should have solid relationships with the contractors performing the work and be prepared to own the investment property until it sells.

• Don’t forget to factor in insurance, taxes, utilities, and ongoing maintenance.

Ways to avoid using home equity

Pay for a wedding or vacation

It can be tempting to use the cash available through home equity financing to you to fund a blow-out wedding or the vacation of a lifetime. But you’ll have difficulty finding a financial expert who thinks this is a good reason to increase your debt.

A better approach:

Save money for these goals so you can pay with your cash flow and/or find budget-friendly ways to pull them off.

Finance a car purchase

You can use a home equity loan or HELOC to buy a car, which may seem like a good idea if interest rates are higher for car loans. Bear in mind, however, that the home equity route will include longer repayment terms, meaning you could still be paying for the car long after you’ve sold it or traded it in. And if you miss payments on a car loan, you risk losing just the car. However, if you miss payments on a home equity loan or HELOC, you risk losing your home.

A better approach:

Shop around for auto loans. Check with multiple lenders to find the best available rates and terms.

Make speculative investments

Maybe a friend or colleague told you about a “can’t miss” stock, which has you thinking about quick ways to get cash to invest. Speculative investing always comes at high risk — a risk too significant to stake your home on. Avoid using your home’s equity for it.

A better approach:

Consider working with a certified financial planner to build a portfolio of investments tailored to your level of risk.

Pay for small emergencies

One thing you learn quickly as a homeowner is that unexpected financial challenges occur frequently. A malfunctioning furnace, a leaky roof, a freezer on the fritz, or a burst pipe are all examples of things that can (and do) go wrong. But these types of issues shouldn’t cause you to go deeper into debt.

A better approach:

Set aside a cash fund to pay for emergencies — experts recommend having a fund equivalent to three to six months of your pay. Adequate homeowners insurance may also help lessen the financial blow of some types of emergency repairs.

The power of home equity

Building home equity and decreasing your overall debt are essential to developing financial stability and building wealth. But used judiciously — with the right mindset and an understanding of the risks — your home equity can also be a powerful tool to help you achieve specific goals.

Frequently asked questions: Best way to use home equity

Is it a good idea to take equity out of your house?

It depends on your mindset, financial situation, and how you intend to use the funds. You want to ensure you have solid financial habits, including a plan to repay the debt. And you should focus your use of home equity financing on investments that will provide a positive financial return. These might include home improvements that add to the value of your home or consolidation of high-interest credit card debt.

How do you take money out of your home equity?

You have multiple options for tapping your home equity to get cash.

• Home equity loan — You borrow money using your home’s equity as collateral. You receive the entire loan amount as a lump sum payment with repayment terms set to a fixed interest rate over a specified length of time. This loan is separate from your original home loan and is a second mortgage.

• Home equity line of credit (HELOC) — You open up a revolving line of credit, similar to a credit card, using your home’s equity as collateral. During the draw period, you can draw money as needed and repay it over time. HELOCs usually have an adjustable interest rate. This loan is also separate from your original home loan.

• Cash-out refinancing — You replace your current mortgage with a new mortgage of higher value. You use the new mortgage to pay off the original mortgage and take the remainder as a lump sum of cash. The new mortgage has a new interest rate, and you’ll pay closing costs.

What can I use a HELOC for?

HELOCs can be used for various purposes, including improvements to increase home value, debt consolidation, paying for higher education, investing in property, or expanding a business.

Can I use a home equity loan for anything?

There are typically no restrictions on how you use the funds from a home equity loan. However, as your home is the collateral in a home equity loan, it’s advisable to focus on ways that add to your property’s value or increase your earning potential.

How do I calculate my home equity?

Home equity is the difference between how much your home is worth and how much you owe on the mortgage. To figure it out, subtract your mortgage balance from your home’s current market value. For example:

Current value: $300,000

Mortgage balance: – $100,000

Home equity: $200,000

You may also see home equity expressed as a percentage. In the example above, $200,000 is 66% of $300,000. So the homeowner has 66% equity in their home.

How can I build equity in my home?

You start building home equity when you buy a home, take out a mortgage, and make a down payment. So let’s say you buy a $300,000 home and make a $60,000 (20%) down payment. That’s your initial amount of home equity.

You can then increase your home equity in three ways.

1. Make your monthly mortgage payments. A portion of each monthly mortgage payment — the principal — goes toward paying down your mortgage, which adds to your home equity.

2. Through appreciation, or the increase in value of your home. If your home increases in value from $300,000 to $350,000, that 50,000 difference adds to your home value.

3. Improve your home to increase its value. Finishing your basement, adding a bathroom, modernizing your kitchen, or adding to your living space are all examples of home improvements that can potentially add value to your home and increase your equity.

AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage

AmeriSave Mortgage Corporation

AmeriSave Mortgage Corporation