Should I get a cash-out loan?

Recent trends in the housing market, including increased home prices and values, make cash-out refinancing an exciting option for many Americans looking for money to spend or invest.

What is a cash-out loan?

With a cash-out refinance, you can get a lump sum of cash for home improvements, renovations, or other needs. It works by replacing your original mortgage with a new mortgage — with a new loan term and interest rate — that leverages the equity you’ve built in your home.

You may be sitting (literally) on a significant source of money

Are you sitting on a “tappable” source of money you could use to improve your home, consolidate high interest debt, pay for your kids’ college tuition, or even take a vacation? If you’re like many American homeowners, the answer is a surprising yes.

That source of money is your home’s equity. And with a cash-out mortgage refinance, you can borrow against it with lower interest rates than what you’d get with a credit card or personal loan.

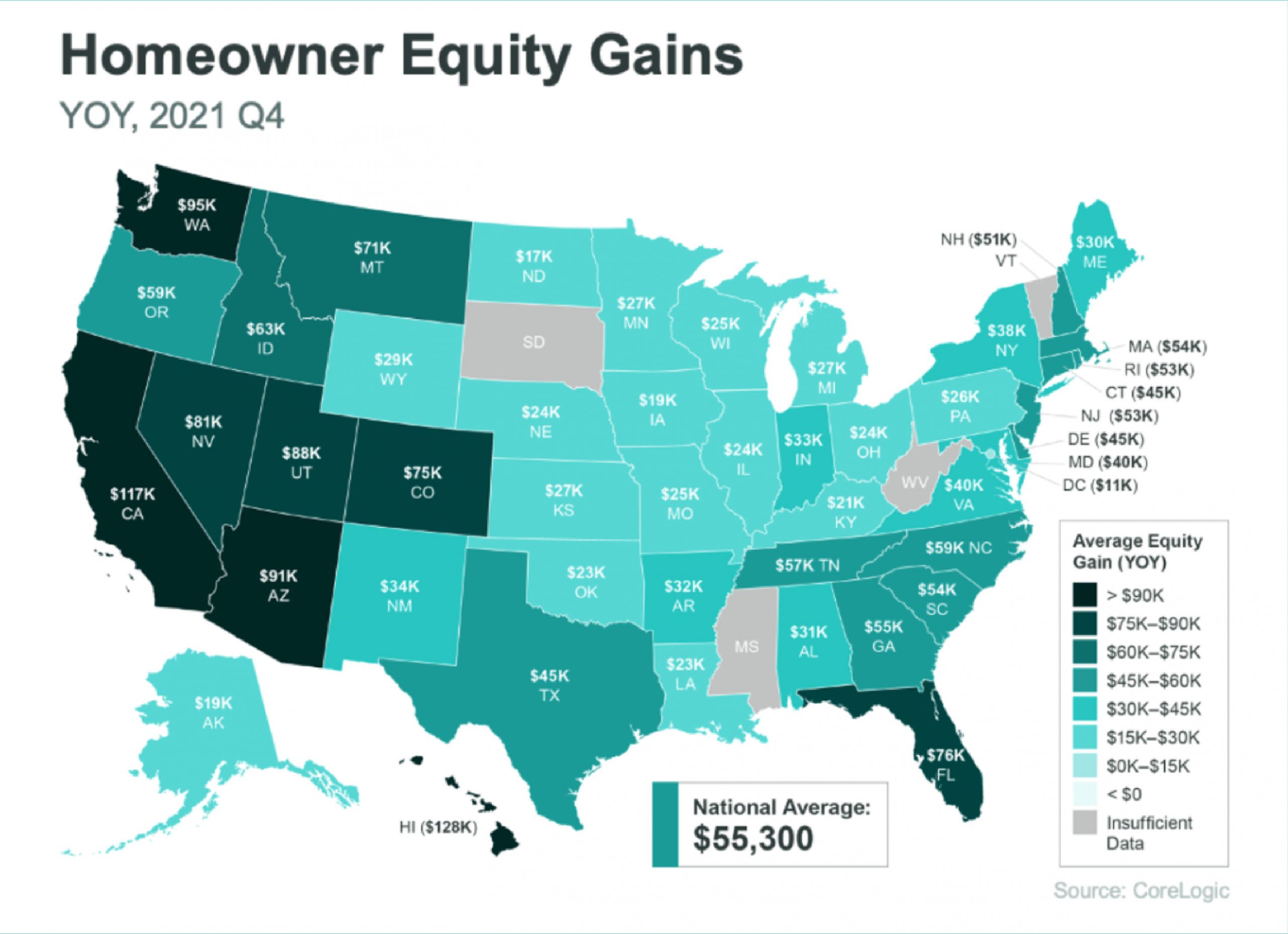

The home equity trend

If you’ve been following the housing market over the past two years, you know that home values have skyrocketed. According to the real estate research firm ATTOM, 45% of mortgaged homes in the US were considered “equity-rich” in the first quarter 2022, up from 31% in the first quarter 2021. Another research firm, Core Logic, reported an 18% rise in home values nationally between the fourth quarter of 2020 and the fourth quarter of 2021, leading to average home equity increases of 29.3%. That’s a whopping $3.2 trillion in additional home equity nationwide, breaking down to approximately $55,000 per homeowner.

That’s right:

The bottom line? As you lived life and went about your business last year, your home’s value likely grew significantly. This drove up your tappable home equity, giving you more money you can now access through a cash-out refinance.

Your home may deserve an appreciative pat on the roof!

Why is cash-out refinance growing in popularity in 2022-23?

It’s perhaps no surprise that cash-out refinancing has gained — and is continuing to gain — in popularity. According to recent data from Black Knight, a provider of software and data to the mortgage industry, cash-out refinancing grew by 20% in 2021, with homeowners accessing a grand total of $280 billion in home equity.

And with home values expected to continue to rise — Zillow predicts a 14.9% increase from March 2022 through March 2023 — you can expect homeowners to continue to tap into the money they’re literally sitting on.

Interest piqued?

Thinking of ways you could use the money wrapped up in your home’s growing equity?

Let’s look at the nuts and bolts of how you can access those funds through a cash-out refinance. We’ll also explore some alternatives that allow you to tap your home’s equity if you think cash-out refinancing isn’t right for you.

How does a cash-out refinance work?

With cash-out refinancing, you replace your current mortgage with a new mortgage of higher value. You use the new mortgage to pay off the original mortgage and take away the rest in cash. Your new mortgage will have its own repayment schedule and interest rate (fixed or adjustable), just like the old one.

Here’s an example of a cash-out refinance:

- Imagine you bought your home ten years ago for $250,000, putting 20% down on a 30-year mortgage with a 5% fixed rate.

- After a decade of mortgage payments, you now owe about $150,000 to the lender. However, your home’s value has risen from $250,000 to $400,000! The equity is your home’s value minus what you owe, so that calculates as $400,000 – $150,000 = $250,000

- Typically, a lender will let you borrow up to 80% of your equity in a cash-out refinance. That’s $200,000 in our example. Maybe you don’t need that much … let’s say you’d like $50,000 to remodel a bathroom.

- You speak with a lender, who approves you for a cash-out refinance.

- You get a new 30-year fixed-rate mortgage for $200,000. This pays off the original mortgage and leaves you with $50,000 cash for your project.

- You need to pay closing costs, typically 2% – 5% of the loan amount ($1,000-$2,500 in this example). You might want to adjust your cash-out amount for this.

- Finally, $50,000 goes into your bank account. You and your spouse can make a date to pick out tile, fixtures, and vanities.

Cash-out refinancing requirements

- Like with your original mortgage, you’ll need to meet your lender’s requirements to qualify for a cash-out refinance. These typically include:

- A third-party appraisal to determine your home’s value (Zillow can give you an estimate, but your lender will need a thorough appraisal)

- Home equity at least 20% of your home’s value

- A credit score of 620 or higher

- A debt-to-income (DTI) ratio of 43% or less

- Verification of income and employment

- Mortgage seasoning: You’ve owned the home and paid the mortgage for at least six months

Cash-out refinance pros and cons

Just because you have home equity, a need for money, and you meet the lender requirements doesn’t necessarily mean a cash-out refinance is right for you. A cash-out refinance comes with advantages and drawbacks that you ought to understand before diving in.

Pros of a cash-out refinance

- Depending on your home’s equity and your existing mortgage balance, you might be able to access tens or hundreds of thousands of dollars.

- The interest rate for a cash-out refinance will likely be significantly lower than what’s available with other loan options.

- If you use your cash-out refinance to make home improvements, you might be eligible for certain tax advantages (talk to a tax professional to learn more).

- If you use your cash-out refinance to consolidate credit card and other high interest debt, you may improve your credit score.

Cons of a cash-out refinance

- A cash-out refinance is a new loan with a new loan term (up to 30 years), so you’ll find yourself starting all over again with paying interest to the lender. If you’ve nearly paid off your primary mortgage, this could be a tough pill to swallow.

- If you’re unable to repay the refinance loan, you’ll run the risk of foreclosure.

- Because you’ll be starting a new loan, you’ll likely pay more in interest in the long run.

- As with any new mortgage, you’ll have to pay closing costs. These are typically 2% – 5% of the loan value.

Cash-out refinance alternatives

Okay, so maybe you’re on the fence: A cash-out refinance will provide you with the money you need, but you’re unsure about some of the drawbacks. The good news is that there are some other ways to tap into your home equity to get cash for projects or other uses.

Home equity line of credit (HELOC)

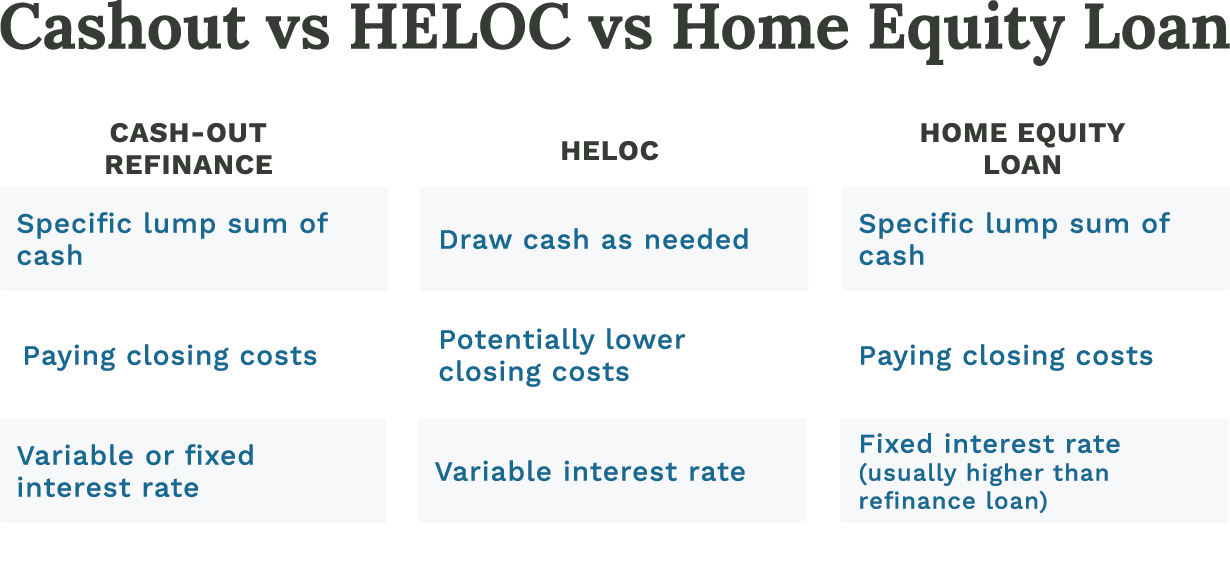

Whereas a cash-out refinance pays off your original mortgage, a home equity line of credit is a type of second mortgage with its own term, interest rate, and repayment schedule.

Typically with a HELOC, rather than receiving a lump sum of cash all at once, your lender will extend a line of credit that you can draw from as needed over a particular period. The draw period can vary, and usually have a minimum initial amount. You’ll make repayments to the lender, including principal and interest. You’ll no longer be able to access the line of credit once that draw period ends, but you’ll continue repayment for up to 20 years.

HELOCs usually have no closing costs and are generally offered with a variable interest rate. They may also be more advantageous than a cash-out refinance if you don’t need a significant and immediate influx of cash. Your HELOC would be there if you need it (for the draw period, at least).

Home equity loan

A home equity loan allows you to borrow a specific amount of money. You’ll receive it in a lump sum, as with a cash-out refinance.

Unlike a refinance, a home equity loan doesn’t involve paying off the original loan. Instead, it’s considered a second mortgage. You’ll have closing costs, plus a separate interest rate and repayment period lasting up to 30 years. However, the interest rate is likely higher than with a cash-out refinance, as the lender assumes a more significant risk. If you’re unable to keep up with the payments, you’ll run the risk of foreclosure.

A home equity loan’s chief advantages include that large sum of cash, stable monthly payments, and a fixed interest rate.

Cash-out refinance vs. HELOC vs. home equity loan: Which is best?

Scratching your head yet? Here’s a quick rundown of these three options:

Unfortunately, there’s no simple answer to the question, “which is best?” It’ll depend on your cash needs, overall financial situation, ability to repay, and risk tolerance.

- As you consider these options, ask yourself a few questions:

- Have I built enough equity to take advantage of a cash-out refinance?

- Do I need a lot of cash right now, or just the ability to draw small amounts of cash over time?

- Do I prefer a fixed interest rate, or am I okay with a variable rate?

- If I’ve paid down most of my mortgage, am I comfortable with a new mortgage of up to 30 years?

- Am I comfortable with paying closing costs?

- Am I comfortable with making two monthly payments?

Use our handy calculator to see if it makes sense to use a cash-out refinance to tap into your home’s equity.

A cash-out refinance is something you should consider

These are extraordinary times for the housing market. Much of the focus in the media is on the business of buying and selling homes, dwindling inventories, and rising home prices. Less attention is being paid to how homeowners like you might be able to tap into your home’s growing equity with a cash-out refinance.

If you’re looking for a source of low-interest money for home improvements or other needs, a cash-out refinance is something you ought to consider.

AmeriSave Mortgage Corporation

AmeriSave Mortgage Corporation

AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage

AmeriSave Mortgage Corporation

AmeriSave Mortgage Corporation AmeriSave Corporation

AmeriSave Corporation AmeriSave Mortgage Corporation

AmeriSave Mortgage Corporation