The House Closing Process: What You Need to Know

If the home-buying process is a marathon, then closing is the marathon’s final mile — but with hurdles between you and the finish. The good news? The finish line is indeed within sight. And armed with a bit of knowledge, you’ll easily leap those final hurdles on the way to being a homeowner.

How long does it take to close on a house?

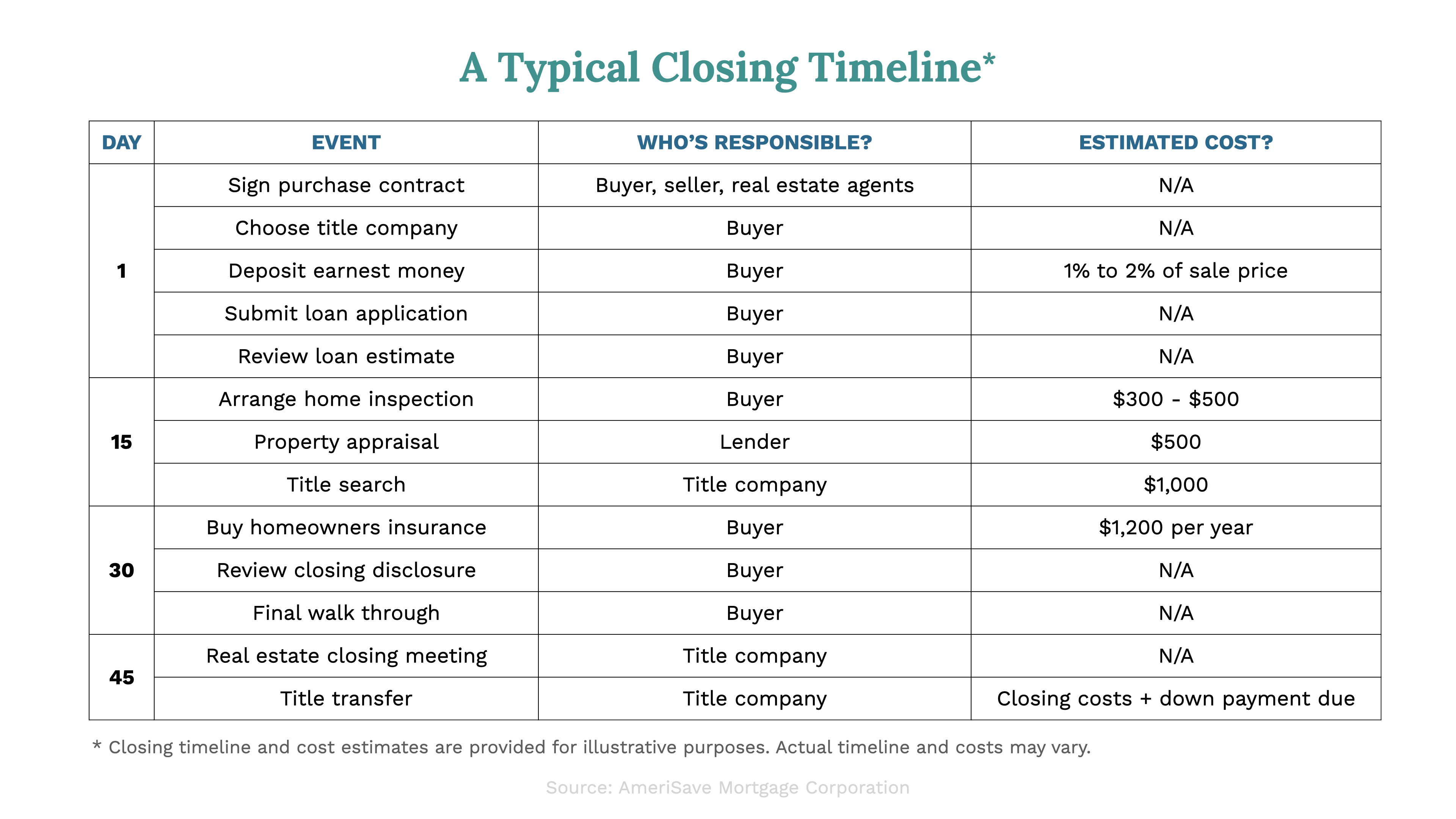

The real estate closing process involves several steps between the acceptance of the purchase contract (signed by both you and the seller) and your officially taking ownership of the home.

The run-up to the closing date often typically lasts 30 to 60 days. (On average, AmeriSave Mortgage loans average 6 days between approval date and funding date for purchase transactions.*) It involves multiple parties: you and the seller, your mortgage lender, a title company, an escrow agent (which could be the title company), your real estate agent, and possibly an attorney.

As the buyer, you have a list of things you need to take care of during this time. These tasks range from getting the lender the information it needs to provide final approval on your mortgage to lining up the money required for your down payment, closing costs, and other expenses.

Closing concludes with a meeting at the office of the title company. You’ll sign documents, make the down payment, and pay closing costs. You’ll witness the title transfer and walk out of that meeting as a homeowner.

Your responsibilities during closing

Many things that need to be done during the closing process fall on you, the buyer. But other people, such as your real estate agent, can help guide you through the closing of the mortgage process. Here’s an overview of some of your responsibilities during closing.

Submit the mortgage loan application

Whether or not you got pre-approved for a mortgage loan while shopping for a home, now’s the time to complete and submit the final loan application. Talk to your AmeriSave Mortgage Banker to get the process moving.

Within a few days of submitting the application, the lender should provide you with a loan estimate. This estimate includes your contact information, term, interest rate, closing costs, and other details. Review this carefully and contact the mortgage lender if you find any discrepancies.

Final loan approval may take a few weeks. During this time, a lender appraisal (handled by the lender) ensures the property value aligns with the sale price. It’s also common for a lender to request additional information from the seller — be sure to respond promptly to any such requests.

Choose a title company

A title company is a third-party that performs multiple important functions during the closing process.

First, the title company performs a title search on the home. This critical step helps ensure that there are no ownership disputes, outstanding debts or liens, or outstanding taxes associated with the property. The title company also provides insurance to both the lender and you, should any discrepancy emerge after the property transfers to your name.

Next, the title company usually sets up and manages an escrow account. An escrow account This escrow account will hold funds, such as your good-faith deposit, until the final closing.

Lastly, the title company manages the final closing, ensuring all final paperwork and state-required closing documents are signed, and funds are transferred to the seller.

It’s important to remember that not every homebuyer is able to shop around for the title company of their choice.

Deposit earnest money

If your purchase contract requires earnest money, you’ll deposit this into the escrow account. This good-faith deposit represents your financial commitment to buy the home. If you decide to walk away from the sale for any reason not outlined in the agreement’s contingencies, the earnest money will go to the seller.

Arrange for a home inspection

A home inspection is a third-party property assessment conducted by a dedicated professional. The inspection focuses on the home’s HVAC, plumbing, electrical system, structural elements (such as the roof, foundation, and flooring), and potential safety issues. It also looks for insect infestation or other damage that may impact the home’s value.

You may be able to attend the home inspection, and you should receive a full report of the inspector’s findings. Hopefully, the report is clean, and you can move forward with the closing. However, if the inspection raises any issues, you can renegotiate the sales price or ask the seller to complete any repairs. If you’ve included an inspection contingency in the purchase agreement, you can even choose to cancel the sale and walk away with your earnest money.

Review the closing disclosure

At least three days before closing day, you’ll receive a closing disclosure from the lender (they’re required by law to provide it). This five-page document outlines the essential details of your mortgage loan, including the terms, interest rate, down payment, monthly payments, and other fees.

Read this document carefully, and make sure the details match the loan estimate. Contact your lender immediately if you find discrepancies or have questions.

Buy homeowners insurance

Your mortgage lender will require you to buy homeowners insurance, which provides financial protection if the home is damaged or destroyed by fire, storm, wind, or other incidents. Be sure the coverage limit is based on the cost to rebuild (which may be significantly more than the sale price). An independent insurance agent or broker representing multiple insurance carriers can help you choose a policy that meets your needs.

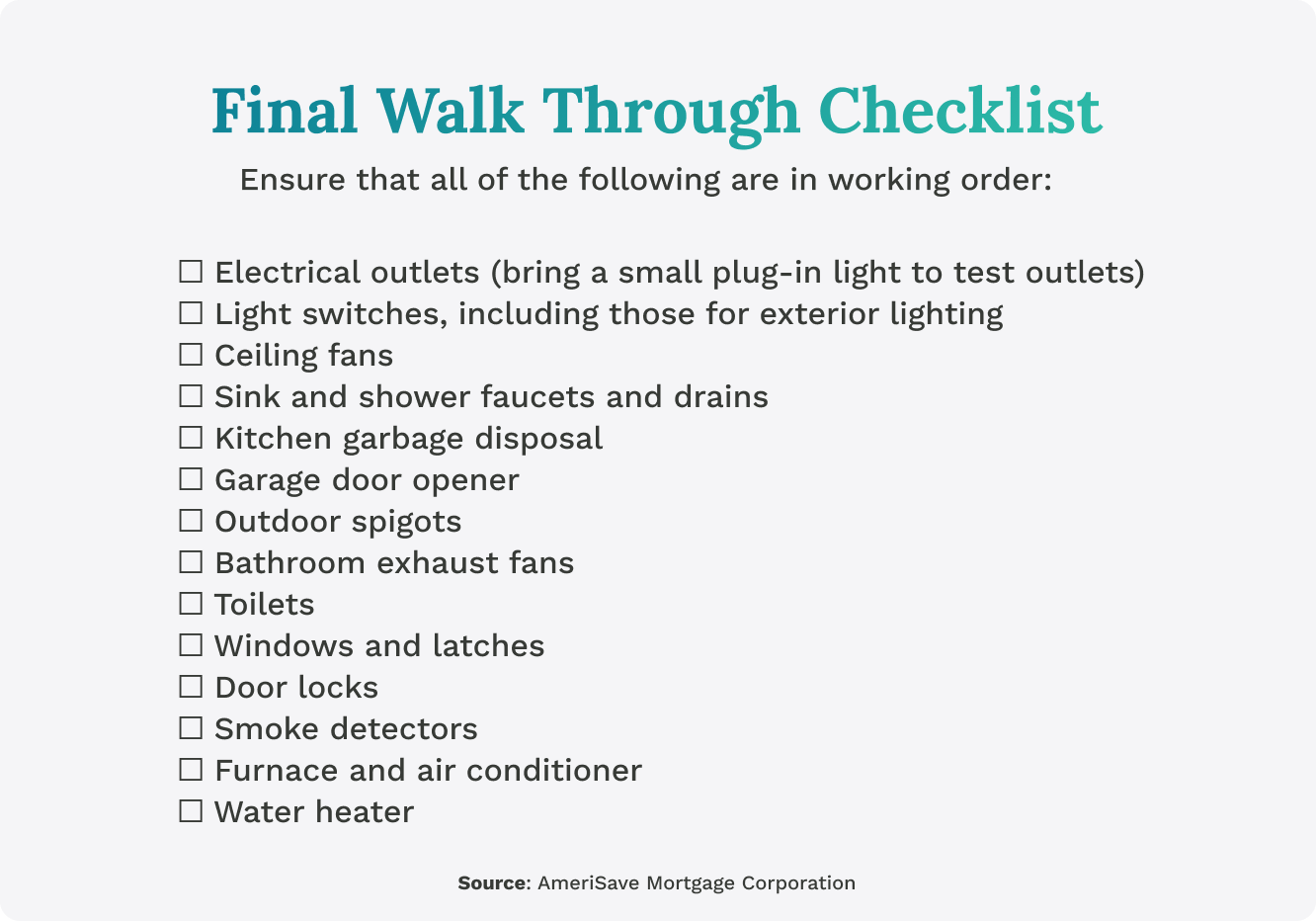

Conduct a final walk through

A final walk through provides one last chance to look at the home before closing day. Take this opportunity to make sure the seller has completed any requested repairs — including those resulting from the inspection report — and that the home is otherwise in the same condition as when you signed the purchase agreement.

Make sure your finances are ready

One of the key hurdles in this final sprint to the finish involves your closing costs and other expenses. Buying a home represents a significant investment, and several elements of the closing process involve a financial outlay.

• Earnest money — A typical earnest money deposit is around 1% to 2% of the sale price. Upon closing, this money is applied to your closing costs.

• Lender appraisal fee — Expect to pay up to $500 for this service.

• Home inspection fee — The cost of an inspection usually ranges from $300 to $500.

• Title insurance — Expect a premium of around $1,000 per policy. This is a one-time fee; coverage lasts for as long as you own the property.

• Homeowners insurance premium — The average cost of homeowners insurance is $1,249 per year, according to the National Association of Insurance Commissioners. Premiums vary based on the value of the home, coverage levels, and discounts.

• Property taxes — You may have to cover property taxes that are prorated for the remainder of the tax year. This cost varies, but your real estate agent can help you find out how much you’ll owe at closing.

• Down payment — Conventional loans require a down payment of at least 3% of the sale price, though 20% is required to avoid private mortgage insurance (PMI).

• Closing costs — These costs are typically around 3% to 6% of the loan amount.

Seller responsibilities

The seller must complete and sign a disclosure form that indicates whether the home has any known issues that might affect its value. This disclosure provides you with even more information about the state of the home. It also limits your ability to sue the seller for any undisclosed issues.

Don’t let hurdles become roadblocks

With the end so near — and homeownership practically within your grasp — you want to do all you can to ensure the closing process goes smoothly.

Be sure to respond to any questions or requests from your mortgage banker or real estate agent as quickly as possible. It’s common for a lender to need additional information to document your income, debts, or savings.

And avoid doing anything during these weeks that could alter your finances and credit score. These include adding debt, quitting your job, paying bills late, making a big purchase (for example, a new car), or changing your bank.

What happens on closing day

When closing day ends, you’ll be a homeowner! However, there’s one final hurdle: a meeting to sign off on the final documents related to the mortgage and real estate transfer.

This meeting typically occurs at the title company’s or lender’s office. It may take place virtually (increasingly common since the pandemic). Besides you and a representative of the title company, your real estate agent may attend. You’ll also want your attorney to attend, should you hire one for the transaction. Plan for the meeting to last up to two hours.

Note that it’s common for the seller to not attend this meeting, and instead handle their title transfer needs separately.

Be sure to have the following ready to go for this meeting:

• Photo ID

• Cashier’s check for the closing costs and down payment (if you’re using a wire transfer, bring proof of the transaction)

• Proof of homeowners insurance, such as your new policy’s declarations page

• Your copy of the closing disclosure

Keep your wire transfers safe

Wire transfers remain, overall, a safe way to move money. However, scams targeting homebuyers do exist. Be sure you confirm verbally (by phone) with your title company before transferring those funds.

Congratulations, homeowner

It started weeks ago with you finding a home and signing a purchase agreement. Now it’s concluded in a title with your name on it. Next up, get the keys and get moved in. The closing process is complete, and you can now start to reap all the benefits (and occasional challenges) of being a homeowner.

Welcome home!

Closing on a home purchase: Frequently asked questions

How long does it take to close on a house?

While some cash-only real-estate transactions can close in about a week, it’s common for mortgage transactions to take up to 60 or more days to complete.

Why does it take so long to close on a house?

Closing can take up to 60 days because there are many steps to the process. The lender has numerous steps to follow to document your ability to repay the loan. Appraisers must follow stringent guidelines. Issues with the title, even if resolvable, often take time to fix.

Many parts of the closing process are beyond your control. But there are things you can do to help move it along. First and foremost, respond quickly and thoroughly to any request from your lender for additional documentation or information. And be sure to take care of other important tasks, such as arranging for a home inspection and buying homeowners insurance, well before your closing date.

Disclaimer

*Approval date is the date listed in the mortgage approval letter and funding date is based on the closing date in the property sales contract. All loans subject to credit approval. Not all applicants will qualify. Actual timelines may vary.”

AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage