What are Mortgage Points and How Can They Help?

Mortgage points are a good idea for many home buyers, though not everyone can benefit from them and for some, they may not make good financial sense. With a bit of understanding and some quick math, you can determine if buying points is a good strategy for you.

Buying mortgage points can help you earn a lower interest rate on your mortgage. Having a lower rate, in turn, helps you save money over the life of the loan. Simply put; by paying points upfront as part of your overall closing costs, you can potentially save a lot of money over the life of the loan.

Let’s take a closer look at this potentially money-saving option for your mortgage.

Are mortgage points something to consider?

You’ve prepared yourself financially to purchase a new home that you intend to live in for many years. By paying down your credit cards and other high-interest debts, you’ve secured a lower interest rate from the mortgage provider. Additionally, you’ve diligently saved for a 20% down payment to eliminate the need for private mortgage insurance (PMI). Furthermore, you have ample funds remaining in reserve.

Feeling empowered, you’re now wondering if there are other ways you can save money over the life of your home mortgage. You may be in a perfect position to buy mortgage points.

How do mortgage points work?

Mortgage points (which are sometimes called discount points) are one of the many things you need to consider when you finance your home purchase.

If current mortgage rates are high, can buy mortgage points from the lender to trim the interest rate on the loan. Each point costs 1% of the loan amount and lowers the interest rate typically by 0.25% (though this percentage may vary by lender). You decide whether you want to buy points while negotiating your mortgage. You then pay for them as part of your closing costs.

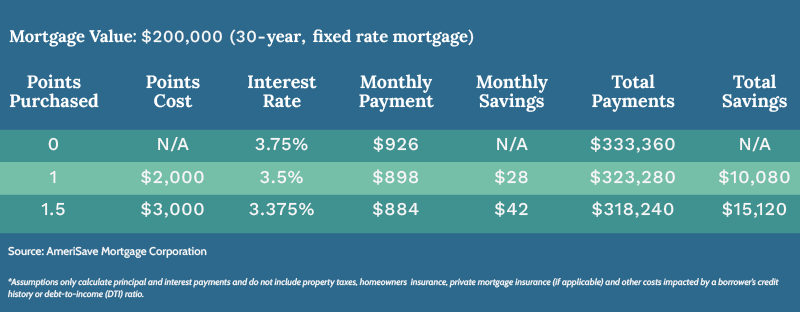

Let’s say you’re applying for a $200,000 mortgage with a 3.75% interest rate. One point would cost you $2,000 at closing and drop the interest rate to 3.50%.

You can also purchase multiple points or fractions of a point. So, in the example above, buying 1.5 points would add $3,000 to your closing costs and drop the interest rate to 3.375%.

Here’s how much you’d save over the life of the loan by purchasing discount points upfront:

Points are generally tax deductible, which means buying mortgage points can help you save at tax time. If you itemize deductions on your returns (as many homeowners do), you can write off the amount of money you spend on mortgage points along with any mortgage interest you pay. Read our comprehensive list of common tax deductions for homeowners to maximize your savings. A certified tax professional can advise you on itemizing your return.

How do I know if buying points is worth it?

Spending extra upfront to save in the long run can be wise. For many, buying discount points makes financial sense. Before deciding, ensure:

Purchasing points won’t impact my down payment.

If buying points reduces your down payment, reconsider. A lower down payment raises your interest rate and may increase PMI costs. With a 20% down payment, avoid PMI.

Consider allocating money to the down payment instead. Your lender can compare scenarios of a larger down payment versus buying points.

I’ll own the home long enough to recoup point costs.

If you plan a short stay, reconsider buying points. It takes time, possibly years, for savings to exceed point costs. Calculate the break-even point: divide point cost by expected monthly savings to determine months needed to benefit.

I’m unlikely to refinance or pay off early.

Consider if you’ll refinance or pay off early, negating long-term savings from points. Points save more over time; early payoff or refinancing could negate savings.

Use our mortgage payoff calculator for savings estimates.

The pros and cons of buying mortgage points

As you can see, mortgage points offer both advantages and disadvantages, depending on your situation. Make sure you understand these pros and cons when deciding whether paying for mortgage discount points is right for you.

Essential Considerations

Mortgage points are one of the tools available to you, as a homebuyer, to fine-tune your mortgage. By allowing you to lower your interest rate, they can help you save money over the life of the loan. But points do come at a cost, and you want to be sure buying them is worth the money you save.

And remember that mortgage points are just one way to save money on your mortgage payments.

Using Points with an Adjustable-Rate Mortgage (ARM)

Yes, you can buy mortgage points with an ARM. Just be sure that the break-even point occurs — and you realize some savings — before the interest rate adjusts. Note that some lenders may provide the points discount only during the initial fixed-rate period.

Differentiating Between Mortgage Points and Origination Points

Mortgage points and mortgage origination points are different things. Whereas mortgage points are credits you buy to earn a lower interest rate, origination points are fees you pay to the lender at closing to process your mortgage. One origination point usually costs 1% of the total amount of the mortgage. So if your lender charges you one point for a $200,000 loan, you’ll pay $2,000 in origination points.

Insight into Lender Credits and Their Functionality

Lender credits do the opposite of what mortgage points do. With lender credits, you pay a higher interest rate in return for paying less for your closing costs. As with mortgage points, you should do the math to understand the long-term financial effect of using lender credits and make sure it matches your goals. Your lender should be able to help you decide whether lender credits are right for you.

Availability of Different Loan Types

Mortgage points are not necessarily available with every home loan. It’s ultimately up to the mortgage lender to decide if they want to give you the option of using points.

Now that you understand mortgage points, you can make a more informed decision as to whether they can help you save. Just remember that they provide their greatest benefit over the long haul — over the life of the mortgage. Learn more about buying a home with AmeriSave.

AmeriSave Mortgage Corporation and its affiliates do not provide tax or financial advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax or financial advice. We encourage you to consult with your own tax or financial advisors about the tax or financial implications of your home loan and to identify a plan that works best for your particular situation.

AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage