Can I Buy a House Without Putting 20 Percent Down?

If you’re thinking about buying a home but concerned that you can’t meet the minimum down payment requirements, there is good news. Yes, there are lower down payment options than the standard 20 percent.

While a 20 percent down payment has traditionally been the standard for new homebuyers, times have changed. These days, mortgage lenders offer numerous lower down payment programs. There are options requiring as little as 5 percent, 3 percent or even 0 percent down, as well as first-time homebuyer programs you can take advantage of. While the minimum down payment varies by lender and mortgage program, let’s look at where the 20 percent down payment figure comes from.

Why would I put 20 percent down instead of opting lower down payment alternative?

When you go with a higher down payment, you’re also reducing the amount of money that you’re borrowing – an obvious, but important point. This helps to determine your loan-to-value ratio (LTV), which expresses how much you’ll owe on your loan – after you pay your down payment. So, a higher down payment yields a lower LTV ratio and mortgage lenders consider your LTV when approving your mortgage application.

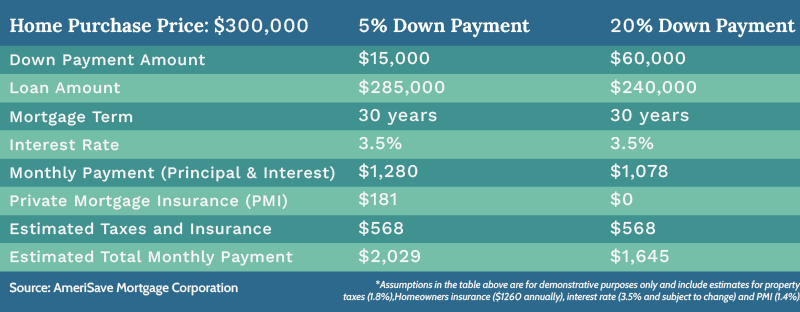

To illustrate how your down payment amount can impact your monthly payment, take a look at the example below, which compares the minimum down payment (5 percent) on a conventional loan to a 20 percent down payment:

Down Payment Comparison for a Home Purchase of $300,000

Another reason some individuals opt for a higher down payment is that borrowers who pay less than 20 percent in a mortgage down payment are typically required to pay for Private Mortgage Insurance (PMI) on top of their monthly mortgage payment. To lenders, a PMI lowers the perceived risk.. Some borrowers work around this issue by taking out two mortgages, the first one typically covering 80 percent of the home price with the second one (known as a piggyback loan) covering ten percent of the home price – leaving ten percent for a down payment and no PMI requirement. Piggyback loans aren’t as common as they once were, though, perhaps because today’s mortgage market has so many viable alternatives to choose from, outlined below.

Alternative Home Loan Options that Do Not Require a 20 percent Down Payment

Alternative #1 – FHA Loan

There are several government-backed, nonconforming loans aimed at assisting lower income households and making homes more affordable, starting with one from the Federal Housing Administration (FHA). FHA mortgage loan programs are ideal for first-time homebuyers, as they offer smaller down payments and can work for borrowers with lower credit scores. In fact, buyers can get an FHA loan with a down payment as low as 3.5 percent of the home’s purchase price, according to the U.S. Department of Housing and Urban Development, the agency that oversees FHA.

However, if you don’t want to pay mortgage insurance, take note that FHA borrowers will need to pay for FHA private mortgage insurance as a result of not putting 20 percent down. These payments usually last for the life of the loan.

Alternative #2 – Down Payment Assistance through City and Federal Programs

In many cities, the local or federal government offers down payment assistance programs to revitalize areas hit hard by natural disasters or recessions. Though they sometimes have income limits, homeowners are often able to obtain assistance if they know where to look. Atlanta and San Francisco are two prime examples, though these programs aren’t limited to big cities. They can be found in towns, counties and states across the country. This means doing your research, contacting your municipal housing authority and potentially working with a mortgage broker who can point you in the right direction. But don’t limit your research to geography. Some employers and professional organizations offer down payment assistance programs as well – it never hurts to ask.

Alternative #3 –Veteran Affairs (VA) Loan

Granted to active servicemembers and veterans (as well as surviving spouses), VA loans are tailored to military families and offer 100 percent financing. Not only that, according to the Department of Veteran Affairs, a VA loan can help buyers purchase or refinance a home at a low interest rate, often without a down payment. In terms of VA loan benefits, borrowers can get reduced closing costs, appraisal costs and loan origination fees. Also, buyers don’t have to pay PMI, regardless of how much down payment they pay, making VA loans a better option than FHA loans in this respect.

To qualify for a VA loan, potential homebuyers must meet specific service requirements and have a good credit score, sufficient monthly income and a Certificate of Eligibility (COE).

Alternative #4 –USDA Loan

Another loan that offers 100 percent financing is the USDA Rural Housing Loan, insured by the U.S. Department of Agriculture (USDA). Primarily designed to encourage homeownership in rural areas, these loans are also available in urban areas (though the agency only approves certain houses, meaning your choice must be USDA-qualified) and require no down payment. Similar to VA loans, USDA loans are quite affordable, but unlike VA loans, they do require borrowers to pay mortgage insurance premiums.

Alternative #5 – Conventional 97

The Conventional 97, available from Fannie Mae and Freddie Mac, only requires a 3 percent down payment. These mortgages usually have slightly higher minimum credit score requirements, but conventional 97 loans allow the borrower to cancel PMI once they reach 20 percent equity. Another advantage? Borrowers are allowed to use gifted funds and even employer or church grants for all or a portion of the down payment.

Other considerations

Some lenders offer no-PMI loans, which means they (the lender) pay for the mortgage insurance. The financial trade-off is that you will have a higher interest rate. This is similar to the trade-off that comes with zero down payment loans, which sometimes means you pay extra fees as part of your closing costs. Check out our guide to home loan interest rates to see which types of loans and money down will affect your rates.

As you ask yourself, “Should I put 20 percent down on a mortgage?” you’ll want to run the numbers on the monthly payment difference, weigh the pros and cons, and then talk to a trusted AmeriSave mortgage banker. They can help you find the right loan program that meets your needs and determine how much to spend on your down payment. Be sure to ask them about other requirements, such as median income levels, minimum credit score thresholds, caps on how much of your gross monthly income can go to housing-related expenses and debt-to-income ratio (DTI) requirements.

At AmeriSave, we can easily check your eligibility for our various loan programs and give you information about smaller down payment options, as well as all of the aforementioned topics.